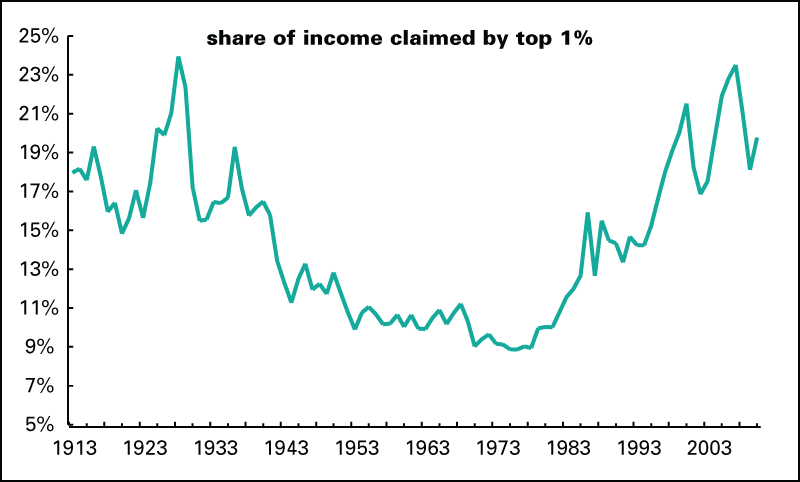

In the late 1910s and early 1920s, courts often ruled in favor of businesses instead of workers. This was even the case during 1918 Hammer v Dagenhart, where Ronald Dagenhart tried to invoke the 10th amendment to enforce a profit when his child was involved with selling a product. He lost the case, and legislation ruled against the poor once again. Calvin Coolidge’s presidential realm came at a time where most of the poor, mainly farmers, suffered while most of the rich were prospering. In fact, it was during his regime that the highest income inequality rate to that date occurred as by 1928, the top 1% of families received 23.9% of all pre-tax income, while about 60% made less than $2,000 annually, which was the minimum livable amount for a family.

After being elected President, Coolidge’s first action was limited aid to farmers. In fact, Coolidge explicitly stated that “well, farmers have never made much money” as reasoning to limit government resources to help them. A farm relief bill was created and backed by the secretary of Agriculture, Henry C. Wallace in 1923-1924, but was ultimately rejected by Congress, leaving farmers helpless. In subsequent years, Coolidge killed off two more farm relief bills, leaving those in poverty in shambles throughout the whole decade. Here, a lack of governmental help towards the farming community increased poverty, and rather prioritized the rich with government funding.

In addition to blocking multiple plans for farm relief, Coolidge killed a plan to produce cheap Federal electric

power on the Tennessee River. The Muscle Shoals Bill was created to build a dam in the Tennessee River and sell

cheaper government-produced electricity. While Congress passed the bills, both presidents Coolidge and Hoover

killed the idea because they didn’t want to waste resources and rather preferred private enterprises to fill that

void. Despite not willing to shed money on the electricity, Coolidge did sign two revenue acts that reduced taxes

on the wealthy. By keeping the cost of energy higher, legislation once again harmed the poor during the 1920s as it

forced those already making under $2,000 annually to divert a significant portion of their budget to cover energy

costs, which often raised the prices of other necessities as well. In addition, by choosing to reduce taxes on the

wealthy, legislation chose to divert funds away from the poor and to benefit the rich, not combatting the glaring

problem of income inequality.

Data from Pew Research Center showing the black poverty rate in comparison to that of whites.