For as long as America has been an independent nation, economic and social inequalities between the rich and poor of America have made up the very fabric of society. The issues of economic disparity were only exacerbated during the early 1900s and the Roaring 20s (1920s).

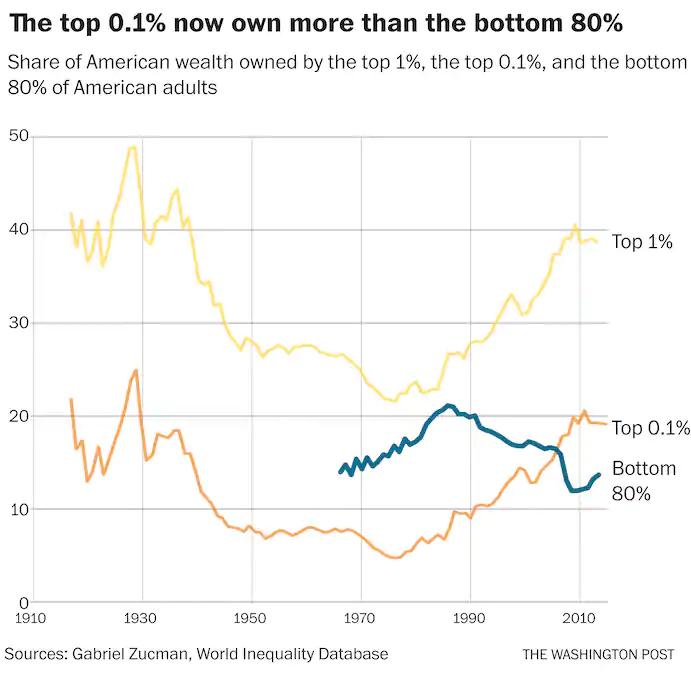

The roots of this divide between the upper and lower classes began in the late 1800s in an era called the Gilded Age. The Federal Government practiced non-interventionist, laissez faire economic policy that essentially allowed the market to function by itself with minimum regulation or constraints. This governmental decision prompted a rise in the power and wealth of the upper class while decreasing that the working class. The rich who owned corporations were able to build up monopolies and large corporations that could set their own high prices, lower their workers’ wages, and increase the working hours of their employees. As a result of the rise of large multifaceted companies that dictated and practically controlled the markets, their owners profited immensely. The top 1% of society held a staggering 38.6% of all money and 4000 families held as much wealth as the rest of the 11.6 million.

The problem of wealth disparities grew and reached a peak during the Roaring 20s. In fact, many historians believe that The Great Depression truly began in the 1920s for many of American Citizens, especially for those in the lower classes. The major reason fueling this lack of prosperity for the impoverished started from an overproduction of goods. During the First World War, both the agricultural and manufacturing had produced an abundance of crops and goods to keep pace with demand from domestic corporations and consumers in addition to America’s European Allies. Unfortunately for these industries, the demand for the overproduced goods and services did not keep up with the supply. Thus, a vicious cycle of overproduction was created to increase profit and therefore consumers were not able to afford a lot of the goods they wanted. Furthermore, the workers were not able to demand higher wages and lower wages due to the tremendous corporations maintained since the times of the Gilded Age.

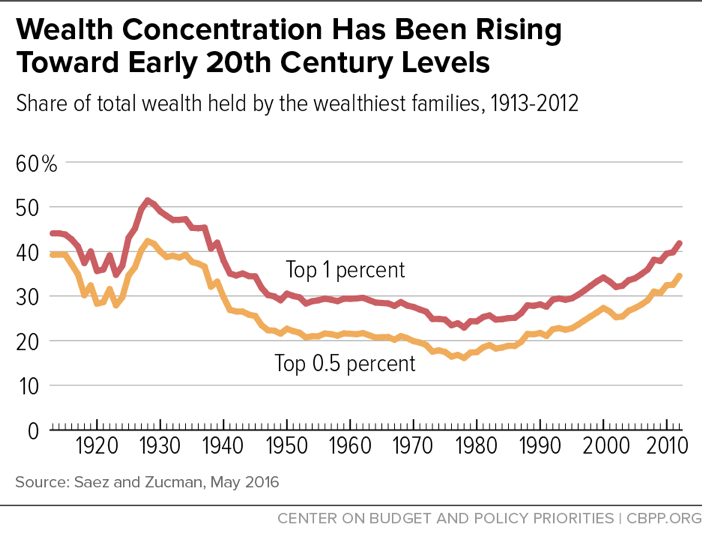

Therefore the 1920’s were only “Roaring” for the very limited wealthy American citizens while the ordinary Americans struggled in one of the worst occurrences of income inequality of all of the Nation’s existence. In fact, 60% of the Nation’s families earned less than the necessary amount required to support themselves. Meanwhile the percentage of wealth held by the rich jumped up from 12% to 19% during the 1920s.

Data from Center on Budget and Policy Priorities showing income inequality reaching its peak levels in the Early 1900s, especially the Roaring 20s